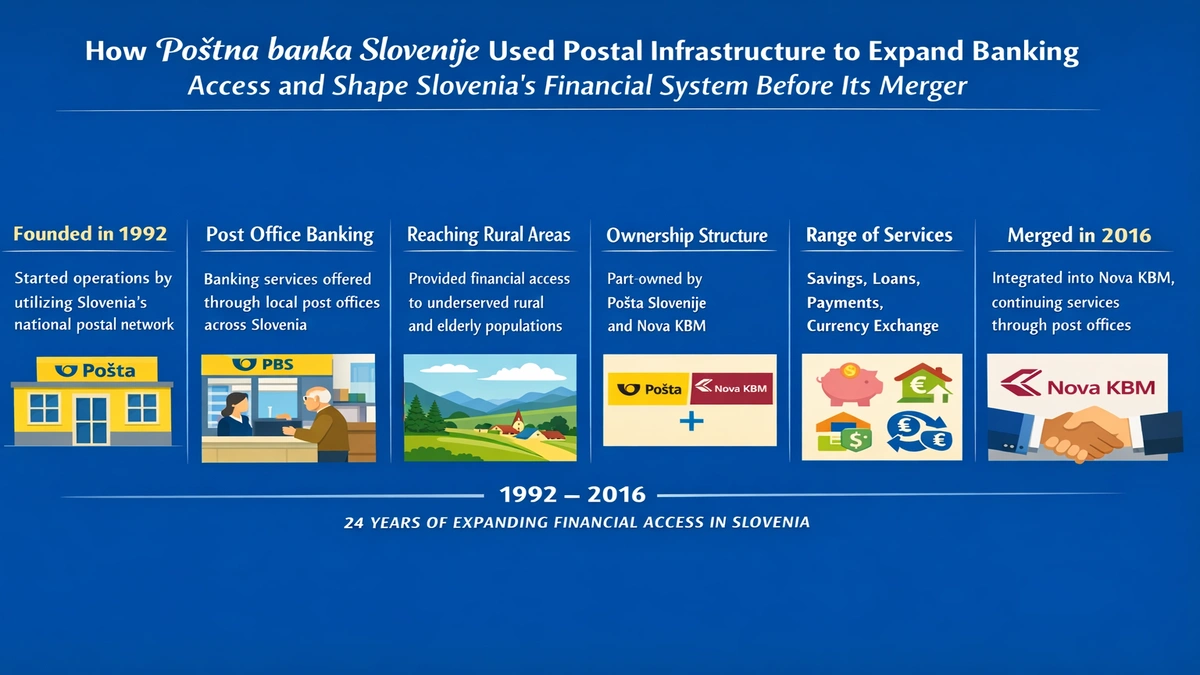

Poštna banka Slovenije emerged at a decisive moment in Slovenia’s modern history, when independence demanded not only political sovereignty but also the rapid construction of trusted national institutions. Founded in 1992, the bank was designed to solve a fundamental post-transition problem: how to provide reliable financial services to citizens dispersed across a small but geographically diverse country, many of whom lived far from established banking centers. The solution was deceptively simple and deeply pragmatic—use the existing postal network as a gateway to banking.

Within its first years, Poštna banka Slovenije embedded itself into daily life by offering banking services at post offices that citizens already relied upon for pensions, payments, and communication. This approach reduced intimidation, shortened distances, and anchored finance in familiarity. For pensioners, rural households, and first-time account holders, the bank often served as their primary point of entry into the formal financial system.

In the first hundred days of operation, the institution demonstrated that banking did not need marble halls or imposing facades to earn trust. Instead, consistency, accessibility, and routine interaction proved just as effective. Over time, Poštna banka Slovenije evolved into a specialized retail and small-business bank, balancing commercial logic with a public-service ethos. Its later integration into Nova KBM marked the end of its independent chapter but not the disappearance of its influence. The bank’s history offers a revealing case study in how infrastructure, policy, and social trust can converge to build inclusive financial systems.

A Postal Bank for a New Nation

The creation of Poštna banka Slovenije was closely tied to the realities of a newly independent state. Slovenia inherited a banking system in transition, with uneven coverage and lingering skepticism among citizens shaped by earlier economic models. Rather than replicate the branch-heavy strategies of traditional banks, the founders of Poštna banka Slovenije chose integration over expansion.

By operating through post offices, the bank instantly achieved national reach without constructing new premises. This was not merely a cost-saving decision; it was a strategic alignment with public trust. Post offices had long served as community anchors, especially in smaller towns, and their counters became spaces where financial services felt approachable rather than abstract.

The model contrasted sharply with conventional banking structures, as shown below.

| Aspect | Traditional Banks | Poštna banka Slovenije |

|---|---|---|

| Physical presence | Standalone branches | Post office counters |

| Geographic reach | Urban-focused | Nationwide, rural included |

| Customer familiarity | Corporate banking identity | Public postal service trust |

| Accessibility | Limited hours | Extended, community-based |

This structure allowed the bank to grow steadily without alienating populations historically underserved by commercial finance.

Ownership Structure and Strategic Alignment

From the outset, Poštna banka Slovenije occupied a hybrid institutional position. It was neither fully public nor purely private, and this balance shaped its trajectory. The partnership between Pošta Slovenije and Nova Kreditna banka Maribor created a framework in which operational reach and financial expertise reinforced one another.

The 2004 shift in ownership, granting Nova KBM a majority stake while Pošta Slovenije retained a significant share, formalized this balance. Strategically, it allowed Poštna banka Slovenije to broaden its product range while maintaining its distinctive distribution model. Retail deposits, payment services, and consumer lending formed the backbone of operations, complemented by offerings for small and medium-sized enterprises.

This alignment also reflected broader trends in Slovenian banking, where consolidation and specialization increasingly defined survival. Poštna banka Slovenije did not attempt to compete directly with larger universal banks; instead, it positioned itself as a complementary institution rooted in accessibility.

Business Model and Service Portfolio

The core business model of Poštna banka Slovenije relied on physical proximity rather than aggressive expansion. Each participating post office functioned as a micro-branch, enabling customers to open accounts, process payments, and access basic credit services in familiar surroundings.

Its retail portfolio included current and savings accounts, domestic and international payments, debit cards, foreign exchange services, and consumer loans. For many households, especially outside major cities, these services covered the full spectrum of financial needs. Small businesses benefited from transaction accounts, cash handling, and modest credit facilities tailored to local economic realities.

This model also carried operational advantages. Staffing costs were moderated through shared infrastructure, and customer acquisition relied less on marketing than on daily foot traffic. Over time, Poštna banka Slovenije became synonymous with routine banking rather than aspirational finance, a distinction that proved resilient even as digital banking gained momentum.

Financial Performance and Market Position

While Poštna banka Slovenije never ranked among Slovenia’s largest banks by assets, its performance was marked by stability rather than volatility. The bank’s balance sheet reflected steady growth aligned with its conservative lending policies. Profitability, though modest, was sustained over long periods, reinforcing confidence among stakeholders.

Its market position was niche but secure. Rather than chasing high-risk growth, the bank emphasized reliability and service continuity. This approach resonated during periods of broader financial uncertainty, when trust became a decisive competitive advantage. Analysts often viewed the institution less as a challenger bank and more as an infrastructural component of the national financial system.

Financial Inclusion and Social Impact

Perhaps the most enduring contribution of Poštna banka Slovenije lay in its social impact. By embedding banking services into everyday postal routines, the institution lowered psychological and practical barriers to participation in the financial system. Elderly citizens collecting pensions, rural residents managing household payments, and small entrepreneurs handling daily cash flows all benefited from this proximity.

Experts in financial inclusion frequently point to postal banking as a mechanism for narrowing access gaps, especially where digital literacy or infrastructure remains uneven. Poštna banka Slovenije exemplified this principle long before inclusion became a global policy priority. Its operations demonstrated that inclusion is not solely a technological challenge but also a spatial and cultural one.

Transition and Integration into Nova KBM

By the mid-2010s, regulatory pressures and competitive dynamics reshaped Slovenia’s banking landscape. Capital requirements increased, compliance costs rose, and economies of scale became critical. Within this environment, the full integration of Poštna banka Slovenije into Nova KBM represented a strategic consolidation rather than a failure.

The merger preserved service continuity while streamlining governance. Customers experienced minimal disruption, and postal outlets continued to serve as access points under the broader Nova KBM framework. Legally, Poštna banka Slovenije ceased to exist as an independent entity, but operationally, its model lived on within a larger institutional structure.

Key Milestones in the Bank’s History

| Year | Milestone |

|---|---|

| 1992 | Establishment of Poštna banka Slovenije |

| 2004 | Majority ownership acquired by Nova KBM |

| Early 2010s | Stable profitability and nationwide coverage |

| 2016 | Legal merger into Nova KBM |

| Post-2016 | Continuation of postal banking services under new branding |

This timeline reflects a gradual evolution shaped more by adaptation than disruption.

Expert Perspectives on Postal Banking

“Postal banking models demonstrate that financial inclusion depends as much on trust and familiarity as on product design,” one analyst observed when assessing European postal banks. Another expert noted that institutions like Poštna banka Slovenije showed how public infrastructure could support private financial activity without sacrificing efficiency. A third emphasized that the bank’s integration into a larger entity illustrated the pragmatic balance between inclusion and sustainability in modern banking systems.

Takeaways

- Poštna banka Slovenije was founded to expand financial access through postal infrastructure.

- Its model prioritized proximity, trust, and routine interaction.

- Hybrid ownership balanced public reach with banking expertise.

- The bank played a significant role in rural and elderly financial inclusion.

- Consolidation reflected sector-wide regulatory and economic pressures.

- The postal banking concept remains relevant beyond the bank’s legal existence.

Conclusion

The story of Poštna banka Slovenije is not one of rapid expansion or dramatic collapse, but of steady integration into the fabric of everyday life. By situating banking within post offices, the institution reframed finance as a public utility rather than a remote corporate service. Its eventual merger into Nova KBM marked a structural transition, yet the principles that guided its creation—accessibility, trust, and pragmatic design—continue to inform Slovenia’s banking environment.

In an era increasingly defined by digital interfaces and algorithmic decisions, the legacy of Poštna banka Slovenije serves as a reminder that physical presence and human familiarity still matter. Its history illustrates how financial systems can grow not only by scaling up, but by reaching out—meeting citizens where they already are.

FAQs

What was Poštna banka Slovenije?

It was a Slovenian bank founded in 1992 that provided banking services through the national postal network.

Why was it different from other banks?

It operated primarily via post offices rather than standalone branches, improving accessibility.

Who owned Poštna banka Slovenije?

It was jointly owned by Pošta Slovenije and Nova KBM, with Nova KBM holding a majority stake.

When did it merge into Nova KBM?

The legal merger took effect in 2016.

Does postal banking still exist in Slovenia?

Yes, postal outlets continue to offer banking services under the Nova KBM framework.